Providing consumers as you achieve their monetary requirements is perhaps all we carry out, this is exactly why we are equipping your with your expert belief, tips, and you may suggestions to obtain there.

- Mortgage Things

- Real estate Alternatives

- Existence & Domestic

- Refinance Possibilities

- APM Insider

Thinking ahead getting Care about-Operating Mortgage Standards

Qualifying to have a home loan when you find yourself thinking-working need not be a problems. Every thing comes down to team. Regardless if you are care about-employed, commission-created, or an entire-time otherwise hourly employee, lenders are all seeking the same thing after you incorporate to possess a mortgage: they wish to be sure there is certainly a premier probability your will be able to pay.

In the place of a beneficial W-dos employee, yet not, it requires a little more legwork to ensure worry about-working earnings. For this reason you want to package to come and make sure your ducks have a-row in advance the fresh new home loan Bridgeport loans process.

Self-operating home loan standards constantly incorporate even more document verification and frequently an effective longer look at the a career record. The good news is, with some date on your side, there are many steps you can take to make sure your mortgage software appears since the excellent that you can in the event the time comes.

Improve Credit rating

As with any borrower, self-employed financial criteria tend to be a glance at your credit score and you can credit rating. So make sure you analysis due diligence until then recommendations gets in front side of somebody else.

You could receive your credit history for free away from any kind of the three credit agencies or regarding freecreditreport . Go over it with an excellent-tooth brush. Contact brand new agency if you find a blunder, you want clarification, or have concerns related your credit history.

Promote a bigger Down payment

A large down payment was an earn-winnings for 2 explanations. First, it reveals the lending company you will be ready to lay surface on the online game. Even if thinking-operating financial requirements range from an advance payment out of only a small amount just like the step three%, of many include a down payment of approximately 20%. A higher matter informs the lending company you have made a life threatening union so you can home ownership. This might be a partnership you’re not going to walk away out-of-about lender’s attention, anyway-if you’ve invested a sizeable chunk of money in this domestic.

The following cause an enormous downpayment can whenever you are seeking to decrease the effects of care about-employed financial requirements is that it lowers how big is the new financing. Consider it. If you would like pick a beneficial $425,100000 domestic, but have only $21,100000 to put down (5%), you will want to be eligible for a beneficial $404,100 mortgage. If the, simultaneously, you might set-out $85,one hundred thousand (20%), you will want to qualify for an effective $340,one hundred thousand mortgage. Plus, you will likely safe a very favorable speed.

Change your DTI

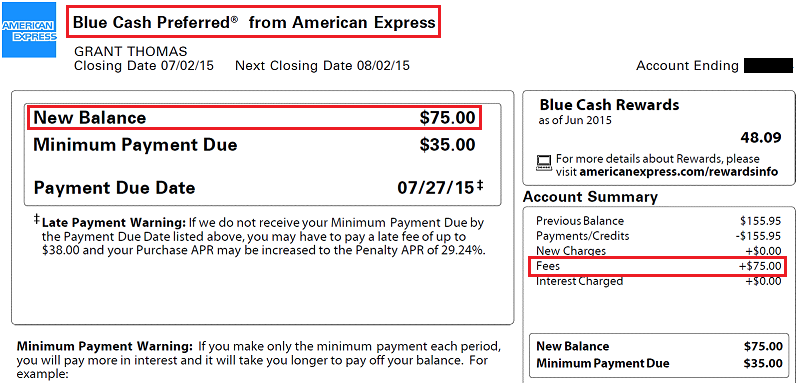

After protecting their tax statements, including a listing of the property and expense, a loan provider will come up with their DTI, otherwise obligations-to-money ratio. It formula adds up all of these expense, along with existing month-to-month mortgage loans, financing, bank card payments, alimony/boy support, and other a fantastic stability. After that it divides one number by your earnings, that may tend to be 1099 repayments from website subscribers whenever you are thinking-employed, and one supplemental income such as for instance rent, expenditures, dividends, old age membership, and you may child help/alimony. The result is the percentage of your revenue that you will be paying for your own financial or any other expenses. We wish to keep your DTI as little as possible whenever qualifying to have a mortgage; 43% otherwise lower than is ideal.

This is actually the material while notice-employed, even in the event. It proportion may include your adjusted revenues, which has certain expenditures reported in your taxation. Some of these expenditures is extra back into for the underwriting of your own mortgage, however, many commonly. It is additionally vital to remember that you can’t are one earnings perhaps not declared in your taxation come back.