It’s really no secret you to student loan financial obligation is put a critical damper in your preparations for the future, especially when considering buying your very first house. Some studies even advise that student loan loans can add a keen extra 5 years to your time it entails people to conserve because of their basic family.

So, should you decide run student loans and then purchase a property? Try to exercise meanwhile? Focus on the domestic earliest?

Decide if to purchase property produces financial experience

Before you even consider how-to get property when you have education loan loans, you must find out whether it makes sense financially to order or if it’s a good idea to save leasing.

If exactly about your financial lifetime lived the same, how long would it not take you to store having a down fee? Why don’t we perform the mathematics.

This new median family speed having an initial-go out customer inside 2017 is actually $182,five-hundred, so you must save $thirty six,500 if you want to possess a 20% downpayment. If you want to purchase your domestic within the next three ages, you’ll need to be rescuing $1,014 30 days.

How long will it take you to expend your student loans?

If you are searching at the same three year months, how long can it elevates to blow your own student loans, and how far can it costs?

The average education loan financial obligation was $28,950 in the cuatro.29%. At this rate, you would have to pay $ monthly for three ages to fully outlay cash out-of.

So, when you yourself have $step 1,100000 offered to set aside monthly, you have got to determine what your priority try: to get a home or expenses the student loan?

Search with the cost of owning a home into the your neighborhood immediately after which play with our very own lease against. buy calculator to find out if its cheaper to invest a good month-to-month mortgage or monthly rent. Don’t neglect to reason for other costs associated with purchasing good home, such as your homeowner’s insurance policies, crisis repair finance, and you will people HOA charges.

If it’s lower to possess a home utilizing the associated costs, it is time and energy to start to look towards the choices such as for example a keen FHA mortgage or other first time home customer program. Such applications helps you be a citizen at some point by eliminating how much cash need to own a downpayment. You might make the money it will save you toward book for every single times and you may incorporate you to towards the education loan percentage to assist pay them off less.

Other monetary a few

Like most economic decision, buying a house or purchasing their college loans isn’t black colored otherwise white. Make sure you happen to be as well as in a position to save money to suit your emergency money, that will security people big scientific costs or other unexpected expenses, and don’t forget pension offers.

Begin planning you buy

Okay, so that you ran the amounts and now is the correct time on precisely how to buy, student education loans become darned! Here is what you need to be thinking about.

Lay a target

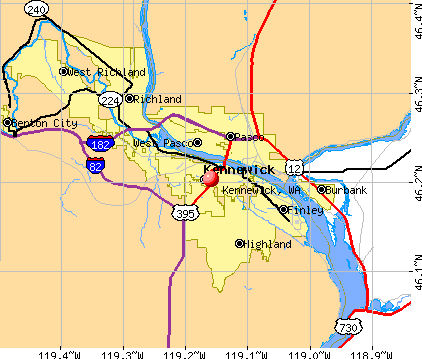

Then chances are you do not have a huge nest egg correct out out-of school, and so the first faltering step within the to invest in a home is actually setting a great goal after which and work out a want to go they. http://www.paydayloanalabama.com/mignon See internet sites particularly Zillow or Trulia to see how much residential property in your area rates. Determine just how much you’ll significance of a 20% downpayment, up coming have fun with our home loan calculator to see exactly what your monthly obligations could be and exactly how much domestic you might really afford.